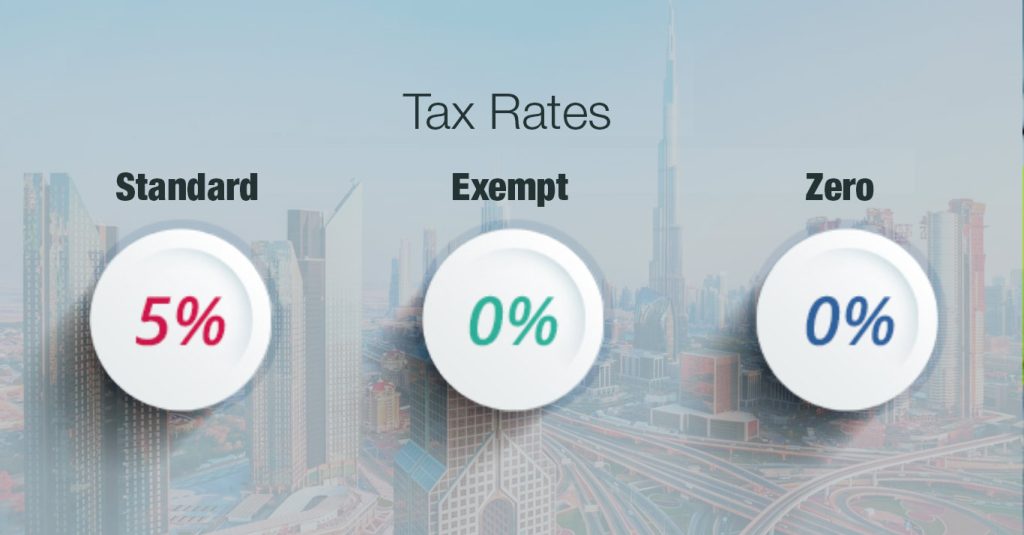

The Value Added Tax system in Abu Dhabi has been in place since 2018. It’s regulated by the Federal Tax Authority, and the standard rate of VAT is 5%. Most goods and services fall under this rate, but there are exceptions such as healthcare and education, which are generally zero-rated or exempt. What makes this system unique in the region is how these exemptions are strictly defined. Businesses and residents must understand the VAT classification of what they’re buying or selling to avoid compliance issues. If you’re new to the city, this may seem confusing at first, but the rules are publicly available and consistent across the emirate.

Who must register for VAT in Abu Dhabi

If a business in Abu Dhabi has a taxable turnover above a certain threshold, it’s required to register for VAT. Currently, this threshold is set at AED 375,000 annually. If a company earns between AED 187,500 and AED 375,000, registration remains optional but still available. These numbers, although approximate, serve as the base for compliance. Non-resident businesses also have to register if they provide taxable goods or services. Registration can be completed online through the Federal Tax Authority (FTA) system. Once registered, a business receives a Tax Registration Number and must begin collecting VAT where applicable.

What are zero-rated and exempt categories

Zero-rated and exempt categories in VAT can seem interchangeable, but they function quite differently. Zero-rated goods and services are taxable but at a 0% rate, allowing businesses to reclaim the VAT they pay. Examples include international transport and the first sale of new residential property. On the other hand, exempt goods and services, such as local passenger transport and certain financial services, do not allow for VAT recovery. This subtle distinction has real implications for business accounting and cost structures. Understanding the boundary between the two can significantly impact financial planning.

How VAT affects consumers in daily life

For everyday residents of Abu Dhabi, VAT mostly shows up as a small addition to purchases. While 5% may not feel overwhelming at checkout, over time, it can accumulate across recurring costs. That’s why it helps to know which items are exempt or zero-rated. For instance, basic education and healthcare services typically don’t add VAT to the bill. Most supermarkets clearly state VAT-inclusive prices, so you won’t be surprised. But it’s still good practice to check receipts, especially for imported goods, where confusion might arise.

How to stay compliant as a business

VAT compliance is a legal obligation for businesses in Abu Dhabi. That means issuing VAT-compliant invoices, submitting tax returns quarterly, and maintaining financial records. These records must be kept for at least five years, a requirement enforced by the FTA. Any delays or errors in filings can lead to financial penalties, even if unintentional. Many businesses in the UAE, particularly new ones, opt to consult local accounting firms to stay in line with regulations. It’s an investment that often saves time, money, and unwanted stress down the line.

What happens when you make a mistake

Mistakes in VAT filing are common, especially for small businesses. The good news is that the FTA allows voluntary disclosure. This lets businesses correct prior errors before the authority steps in. If done promptly and properly, penalties may be reduced. But if errors are repeated or look like deliberate evasion, the fines can be severe. Businesses should act early when they discover discrepancies, no matter how minor. It’s also wise to document all communication and maintain an audit trail for future reference.

Can you recover VAT on your business costs

Yes, you can—provided the expenses are related to taxable business activities. Known as input VAT, this is the amount a business can reclaim on its own purchases. However, this applies only if these purchases are connected to VAT-registered sales. For example, if a company buys office equipment and then uses it for its VATable services, it can claim back the VAT paid on that equipment. Accurate and properly formatted invoices are necessary for successful claims, so attention to detail matters.

How VAT applies to real estate in Abu Dhabi

Real estate is a sector where VAT rules are highly specific. Commercial properties are taxed at the full 5%, both for sale and lease. In contrast, residential properties are mostly exempt—unless it’s the first supply of a new unit within three years of its completion, which qualifies for zero-rating. Developers benefit from this system because they can recover construction-related VAT, but buyers don’t bear the brunt. That’s one of the many reasons why property investment in Abu Dhabi remains active and appealing to both local and international investors.

What you need to know about Free Zones

Free Zones have a special status in the UAE and come with different VAT implications. Goods transferred within designated Free Zones might not incur VAT, but the supply of services usually does. Businesses must verify whether their Free Zone is recognized as “designated” for VAT purposes. They also need to be aware that transactions with the mainland can trigger VAT obligations. This complexity makes it essential for Free Zone businesses to seek professional tax advice.

How to keep up with VAT changes

VAT regulations in the UAE are updated from time to time by the FTA. These updates might involve adjustments in thresholds, formats, or compliance protocols. To keep pace, it’s helpful to subscribe to FTA announcements or consult professionals who monitor such updates regularly. Many businesses set internal reminders to review VAT compliance quarterly, in line with their return cycles. Being proactive in this way helps avoid missteps and can even uncover reclaim opportunities you might have missed.

This guide was written by the www.few.ae editor.