In Abu Dhabi, car insurance is not just a choice—it’s legally required to register and drive any vehicle. There are two main options available: third-party and comprehensive. Third-party insurance covers only the damage you cause to others. Comprehensive plans include coverage for your own car, theft, and sometimes fire or weather-related damage. Choosing between them depends on the vehicle’s value, personal risk appetite, and budget flexibility. Many new car owners in the UAE opt for comprehensive plans, especially when purchasing through a dealership.

Policy renewals are aligned with your car registration deadlines

Insurance coverage in Abu Dhabi always ties back to vehicle registration. Policies typically last twelve months and must be renewed before registration expiry. If not renewed on time, the driver risks penalties, fines, and the vehicle may even be impounded. The Traffic Department monitors these timelines strictly. For residents owning multiple vehicles, aligning policy dates simplifies tracking and avoids missed deadlines. A quick reminder here—driving without valid insurance is illegal in the UAE and can result in immediate legal consequences.

Premiums are calculated based on your history and demographics

One of the most asked questions is why insurance prices vary widely. Insurance companies evaluate several personal factors like age, nationality, driving experience, and previous accident records. A 22-year-old new driver may pay more than a 40-year-old with a clean history. Vehicle make, engine size, and safety features also influence pricing. Additionally, some jobs are seen as higher risk—like delivery drivers—so premiums are adjusted accordingly. Residents are encouraged to get quotes from multiple providers and check for promotional discounts before deciding.

Claim processes are designed to be structured and prompt

If an accident occurs, your first step should always be contacting the police. They will provide a report that is mandatory to proceed with a claim. After notifying your insurer, you usually receive instructions on whether to take your car to an agency garage or an approved one. Some companies allow tracking the repair status via mobile apps. Typically, the car is assessed within a day or two, and repairs begin immediately after approval. Understanding this chain of events helps avoid stress during already tense situations.

Optional add-ons help tailor your insurance to match daily needs

Beyond basic coverage, insurers in Abu Dhabi offer add-ons like roadside assistance, off-road coverage, and natural disaster protection. These extras can be useful depending on your driving habits and lifestyle. For example, if you frequently visit desert areas, off-road cover becomes essential. Parents may consider personal accident cover for additional safety. Although these add-ons raise the premium slightly, they offer peace of mind during emergencies. Always read the policy document carefully before selecting these enhancements.

No-claim discounts reward careful and responsible driving

Drivers who avoid filing claims over a period usually receive a no-claim discount upon renewal. This discount can accumulate yearly, reducing the overall cost significantly. Some companies offer up to 20% off after a few claim-free years. Insurers see these drivers as low-risk and adjust premiums accordingly. If you’re switching insurance providers, ask for a certificate showing your no-claim history. Most companies in Abu Dhabi accept these records, even from other Emirates or GCC countries.

Garage selection affects repair timelines and parts quality

When purchasing a policy, drivers choose between agency and non-agency repairs. Agency garages are brand-specific and use original parts, but often come with higher premiums. Non-agency garages, meanwhile, are authorized partners offering quicker repair turnarounds but may use generic parts. For newer or luxury vehicles, agency repair is recommended to maintain warranty and value. Discussing this during the purchase phase is critical, as changes to this clause after signing can be complex and limited.

UAE-wide compliance ensures consistency across Emirates

Abu Dhabi car insurance follows UAE-wide laws, meaning a policy bought in one Emirate is valid in another. This benefits drivers who frequently commute between cities like Abu Dhabi and Dubai. However, each Emirate may have slight procedural differences, especially when it comes to renewals and vehicle inspections. Abu Dhabi’s registration system links directly to the insurance database, so delays in policy activation can impact renewal ability. Residents should ensure the insurer uploads their details immediately after payment.

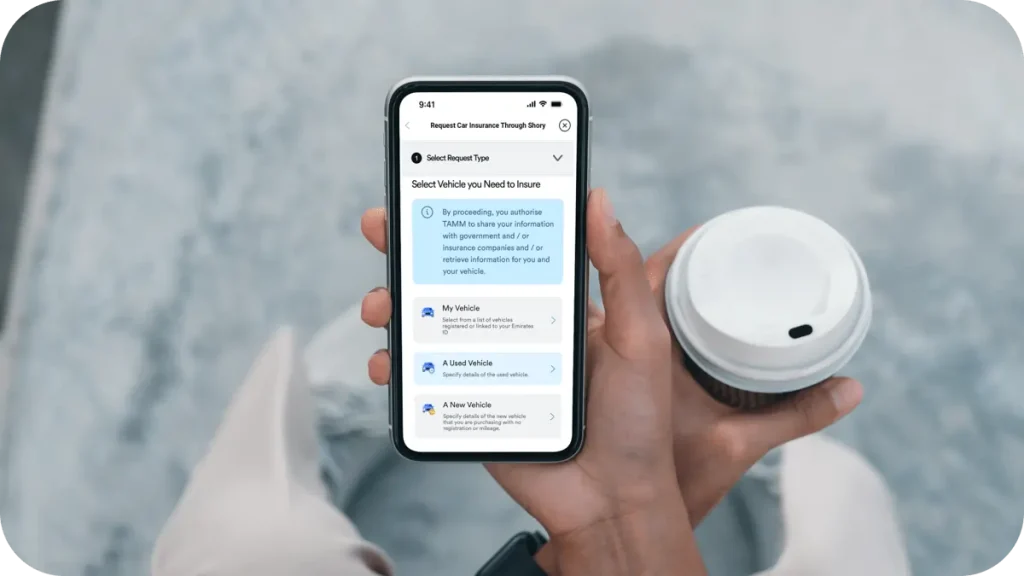

Mobile apps are becoming essential in modern insurance usage

Technology now plays a major role in managing car insurance. Most providers in Abu Dhabi offer mobile apps to view policy documents, renew plans, and report claims. Some apps allow real-time claim tracking or instant chat with support agents. This digital convenience reduces wait times and limits unnecessary travel. It’s especially helpful for expats new to the UAE system, providing step-by-step guidance in English and Arabic. Insurance apps are also integrated with government portals for faster processing.

Local differences highlight why regional advice matters

While Abu Dhabi’s system mirrors Dubai’s in many ways, there are differences in accident reporting and policy structures. For example, some insurers based in Abu Dhabi require in-person visits for verification, whereas Dubai allows digital uploads. Residents often consult friends or neighbors when choosing a provider, but professional brokers can offer tailored options. Understanding these regional distinctions prevents surprises during claims or renewals. This guide was prepared by the editor of www.few.ae using verified insights and local experience.

Properly understanding how insurance functions in Abu Dhabi helps every driver navigate the city more safely.